do you have to pay inheritance tax in arkansas

However if you are inheriting property from another state that state may have an estate tax that applies. You can use the advance for anything you need and we take all the risk.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Learn the residency requirements filing May 02 2022 5 min read.

. It works like this. That means you pay the same income tax rates as you do for other income in the state. Tax Advice Expert Review and TurboTax Live.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Known as a 1031 exchange it allows you to keep buying ever-larger rental properties without paying any capital gains taxes along the way. Your credit history does not matter and there are no hidden fees.

Arkansas does not collect an estate tax or an inheritance tax. Fortunately these taxes are almost a thing of the past. You are also required to maintain liability insurance on your vehicle.

If your probate case does not pay then you owe us nothing. If your home of record is other than Arkansas and you are stationed outside of Arkansas you must register your. Be eligible to work in the US.

And employed full time. Filing for divorce is never pleasant but if you have the right assistance or know-how youll be prepared to start your divorce. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you.

Those states with a tax have a relatively high threshold before taxes are due. By not converting another retirement account to a Roth IRA you can avoid paying taxes now at a higher rate for the conversion and instead pay income taxes on your distributions at a lower rate in. Only a handful of states still collect an inheritance tax.

Knowing what to do May 02 2022 5 min read. Capital gains are taxable as personal income in Arkansas. You can use the advance for anything you need and we take all the risk.

Alabama is one of the few states that does not exempt food from sales tax. Eligibility requirements include. You will also likely have to file some taxes on behalf of the deceased.

Before renewing your license you are required by Arkansas law to assess your vehicle with your county assessor and pay all personal property taxes you owe. The individual must be 24 years or older. When you die there are many federal and estate tax situations that need.

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Access to tax advice and Expert Review the ability to have a Tax Expert review andor sign your tax return is included with TurboTax Live or as an upgrade from another version and available through December 31 2022.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. Intuit will assign you a tax expert based on availability. If you have reason to believe youll be in a much lower income tax bracket in retirement then a Roth IRA conversion may not leave you better off.

If your probate case does not pay then you owe us nothing. The IRS lets you swap or exchange one investment property for another without paying capital gains on the one you sell. Other Necessary Tax Filings.

Localities can add as much as 75 to that and the average combined rate is 922. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Do a 1031 Exchange.

Even with the federal exemption from death taxes raised retirees should pay more attention to estate taxes and inheritance taxes levied by states. Please contact your financial institution and have the above Originator IDs debit block removed if applicable. If you live in North Dakota and need to get a divorce youll need to know about the law and procedures.

June 11 2022 Most-Overlooked Tax Deductions and. Inheritances is also exempt from the Arkansas income tax. Arkansas has no estate or inheritance tax.

An inheritance tax is a state-imposed tax that you pay when receiving money or property from a deceased persons estate. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you. Long-term capital gains receive an exemption of 50 meaning that 50.

Your credit history does not matter and there are no hidden fees. There is no obligation. Failure to do so could result in the ACH Debit transaction being returned by the bank as not payable and possible fees and penalties assessed by your financial institution and the Dept.

Have at least two years of. There is no obligation. Arkansas Capital Gains Tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

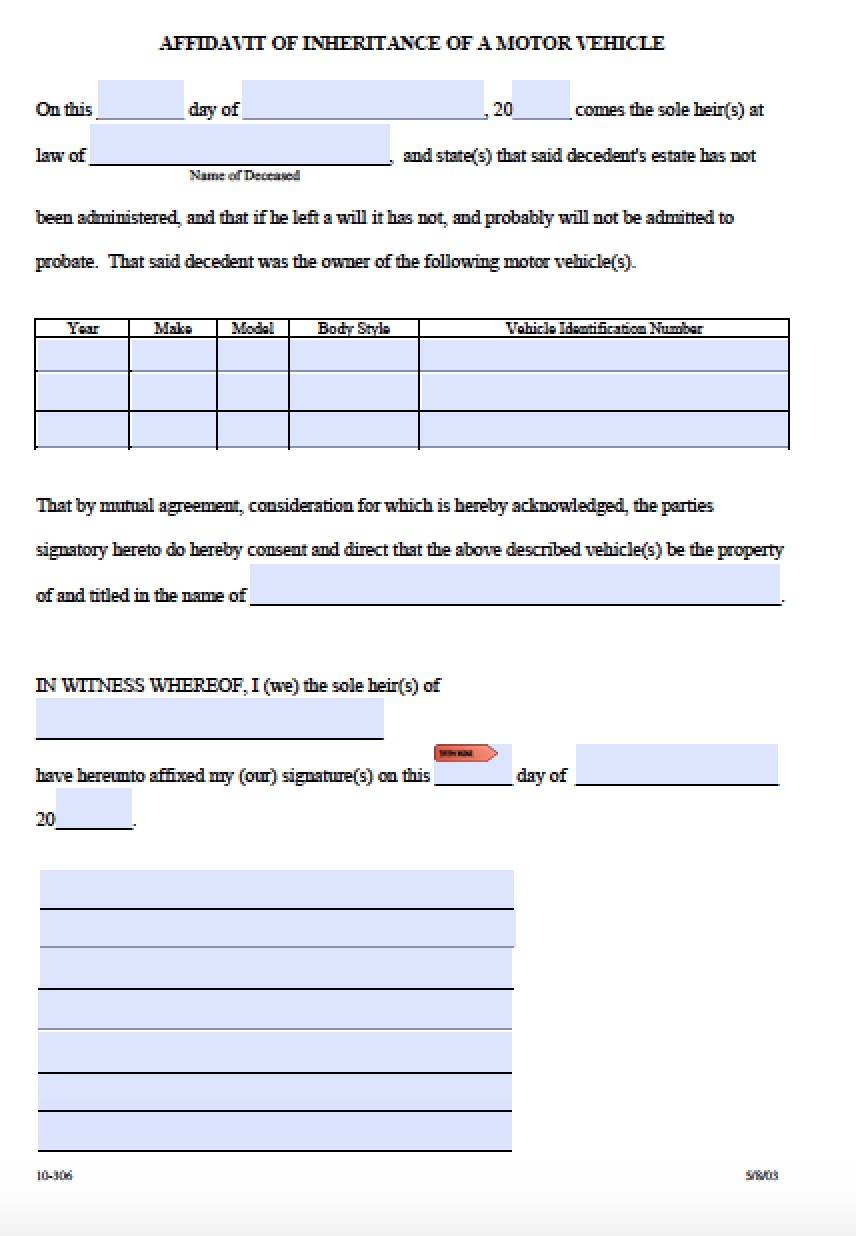

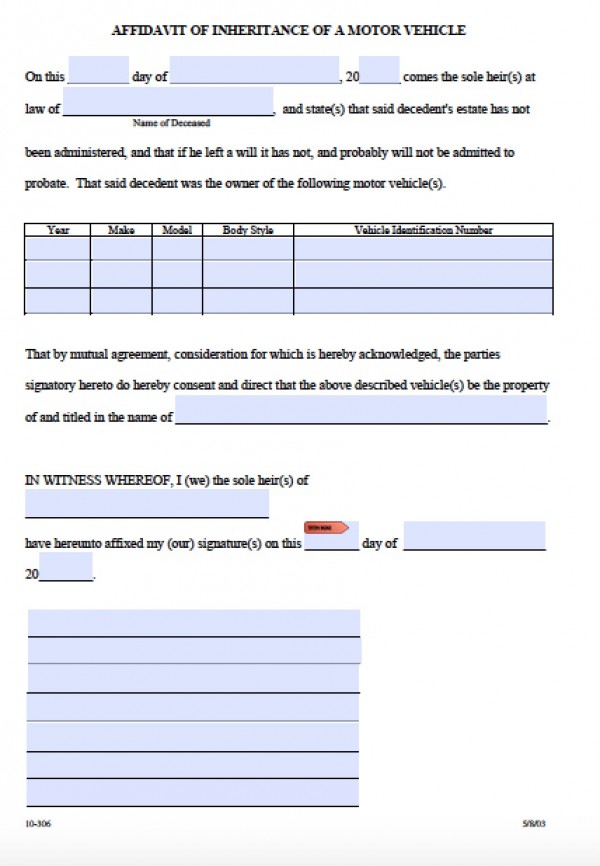

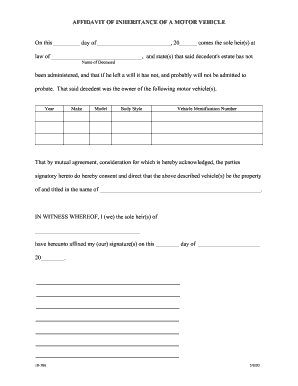

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word

Affidavit Inheritance Form Fill Online Printable Fillable Blank Pdffiller

What Does Funding My Living Trust Mean And How Do I Do That

States With No Estate Tax Or Inheritance Tax Plan Where You Die

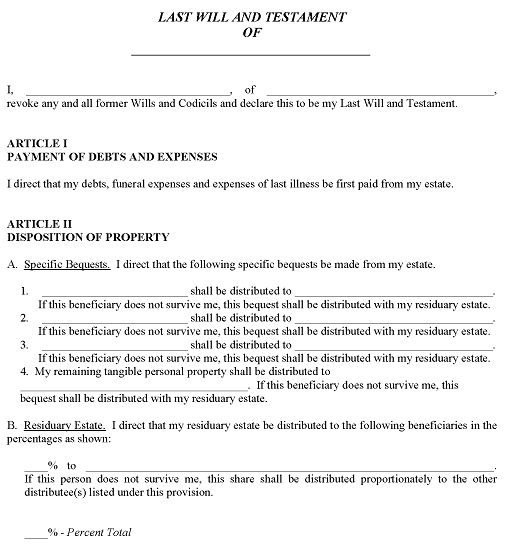

Free Arkansas Wills And Codicils Pdf Word Free Printable Legal Forms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Retiring In These States Will Cost You More Money Vision Retirement

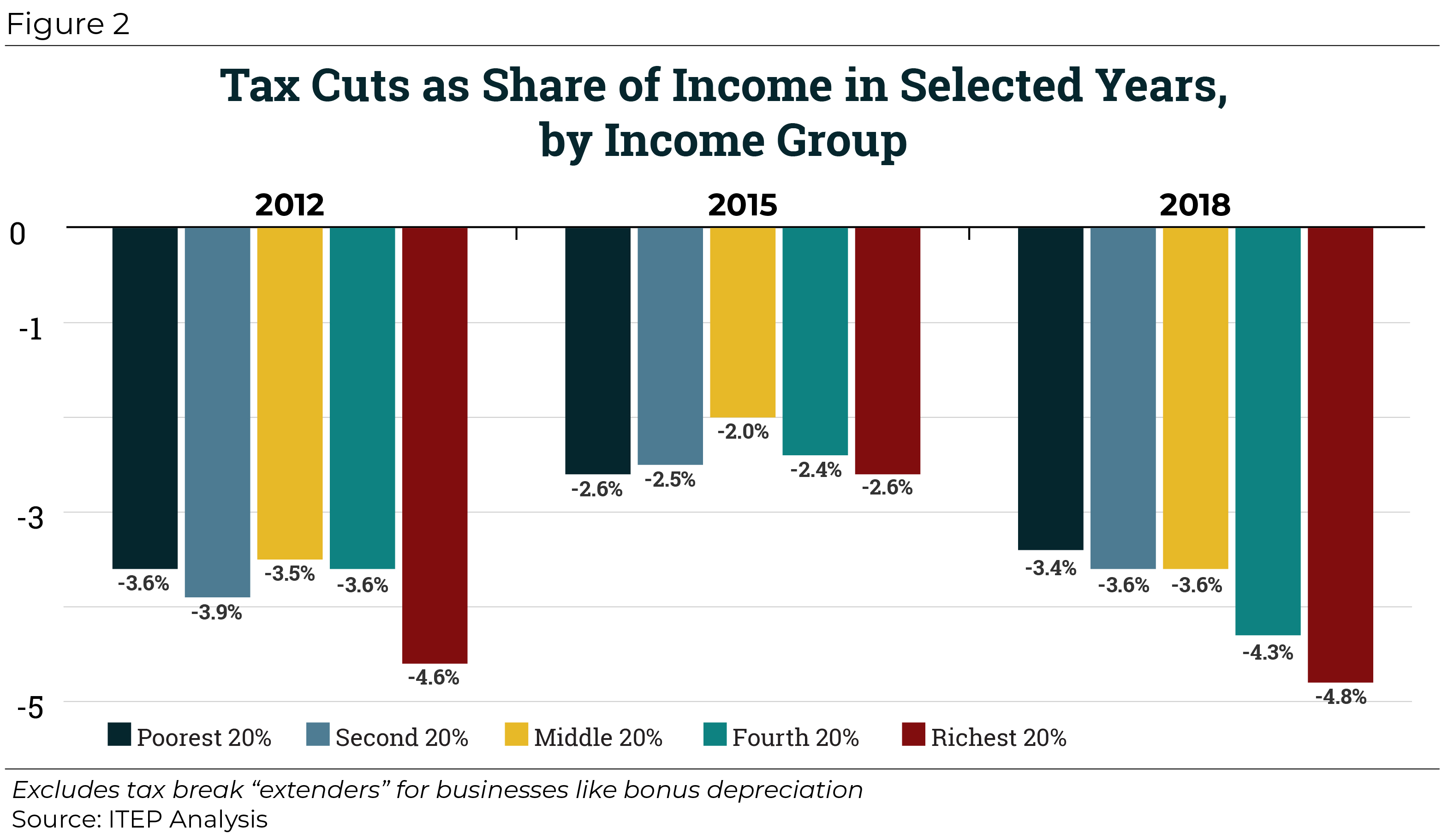

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Annuity Beneficiaries Inheriting An Annuity After Death

Retiring In These States Will Cost You More Money Vision Retirement

Free Arkansas Affidavit Of Inheritance Motor Vehicle Form Pdf Word

Affidavit Inheritance Form Fill Online Printable Fillable Blank Pdffiller

Here S Which States Collect Zero Estate Or Inheritance Taxes

How To Settle An Estate Pay Final Bills Dues Taxes And Expenses Everplans

Here S Which States Collect Zero Estate Or Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die